Find unclaimed money with Claimo

With inflation at an all-time high, and the cost of living far exceeding the average Aussie’s household budget, now is the perfect time to hunt down money that you may be owed. You could find unclaimed money in old credit card bills, loan documents or car insurance add-ons you were mis sold.

What many don’t know is that there are billions of dollars in everything from bank accounts, shares, investments and life insurance policies available to get back. This might occur when people neglect to update their contact information with a financial institution or firm after moving or travelling abroad. Or perhaps individuals are ignorant that they have a legitimate claim to money.

If they were offered unnecessary insurance add-ons, those who bought a car on finance, took out a credit card, or loan before 2018 may be able to get a refund.

Through ASIC’s Moneysmart unclaimed money finder, consumers may be able to access

more than $1.5 billion. Remember, that this is a free service so if you’re approached by a

company to a pay a fee to find unclaimed money there are free options available.

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Service Industry in 2019 recognised the misleading practice, directing the banks to contribute to a $10 billion junk insurance refund pool. This means millions of Australians could be owed a piece of the pie.

Any loan taken out prior to 2018 is worth investigating and anyone who took out a loan in the 1990s should investigate whether they had paid add-on insurance on loans or credit cards.

Most victims don’t even know they have paid for junk insurance or could be owed a refund.

Even if they took out a loan with a respectable bank or lender, consumers should check.

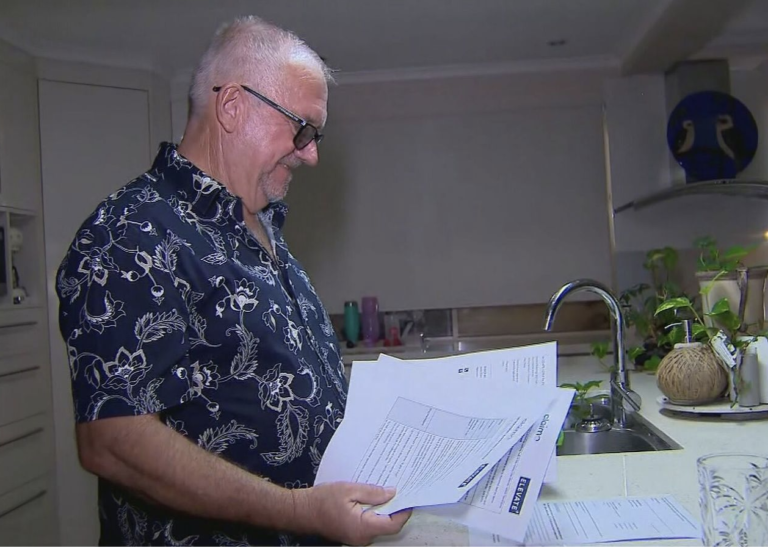

Aussies like Stuart Mitchell from Queensland, who received a refund of $15,000 could be eligible for a junk insurance refund.

If you want to learn more, or find out if you have paid junk insurance lodge and enquiry

today.