Aussies getting thousands back from ‘junk insurance’ claims

How to check if you’re owed money?

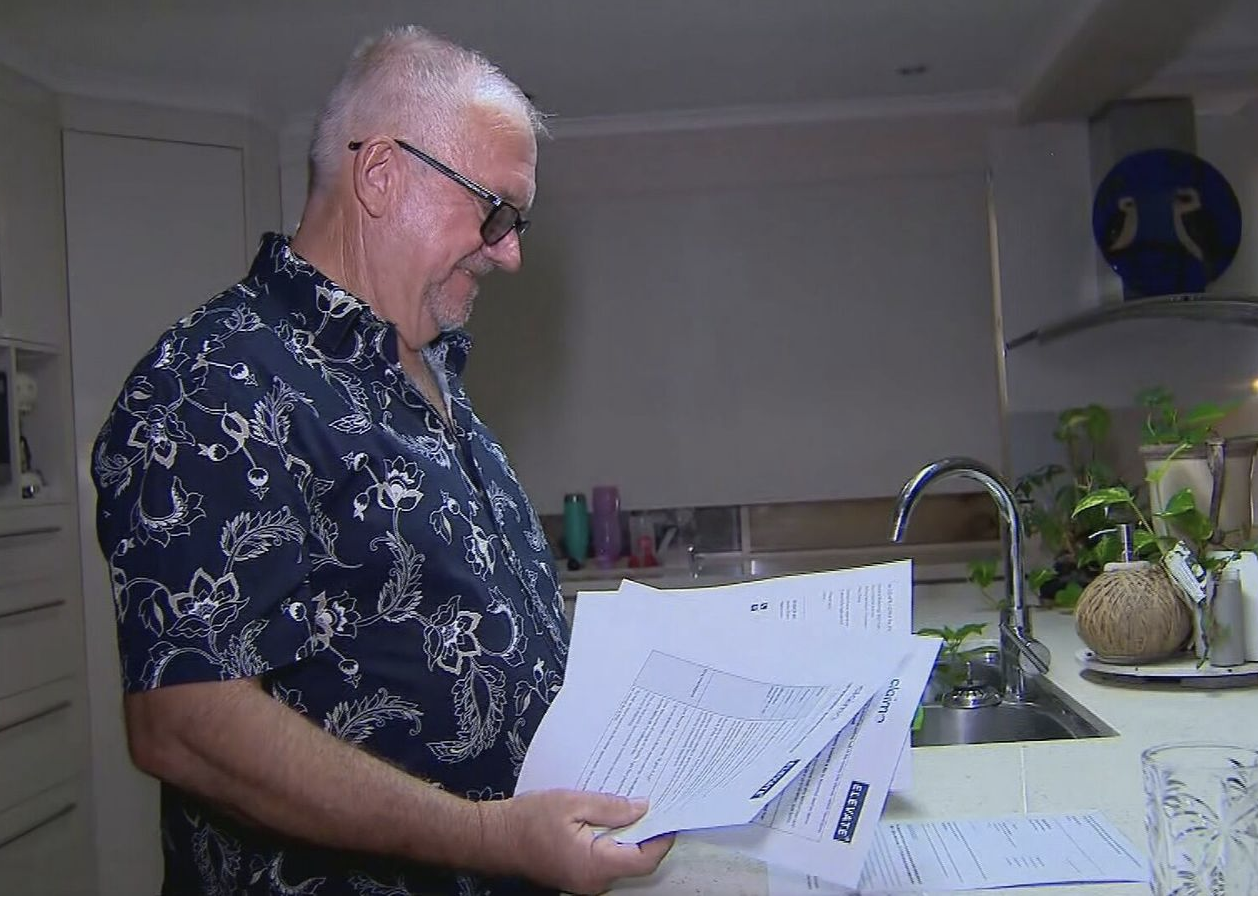

The first stage of the process would be to check your loan or credit card documentation. Don’t worry if you no longer have your documents, Claimo will request these for you.

We will send an information request to your banks and financial institutions to see if you have been charged for add-on or junk insurance.

If you have been charged for junk insurance, one of Claimo’s claims specialists will give you a call to discuss your eligibility. When financial firms confirm that you have not been charged for the insurance, we will close that part of your enquiry. We don’t charge if you do not have insurance.

Claimo will then submit a claim on your behalf and manage the process for you from start to finish. On average, the claims process can take around 12 weeks once your claim has been submitted.

Our junk insurance claims managers will give you regular updates as they come. For more information about junk insurance, please read our full junk insurance guide here.