Add-On Insurance Deadline

Updated: June 10th, 2025:

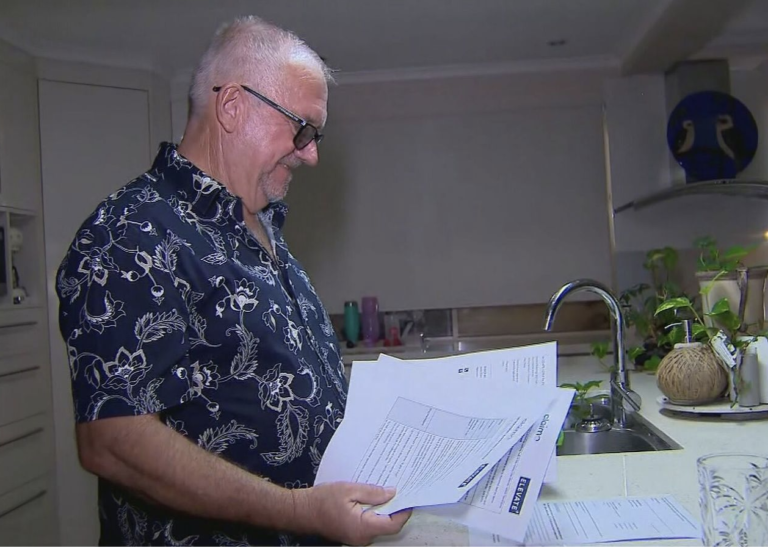

If you purchased add-on insurance and believe you may have been misled, please be aware of an upcoming deadline for submitting your complaint. The Australian Financial Complaints Authority (AFCA) is handling these cases, and Claimo is here to assist you.

Add on insurance is a type of insurance that is offered to consumers in addition to another product, including: Consumer Credit Insurance (CCI), Guaranteed Asset Protection Insurance (GAP Insurance), Tyre and Rim Insurance and Extended Warranty / Mechanical Breakdown Insurance. Learn more about add-on insurance from our blog here.

Updated Information: June 2025

The deadline for lodging complaints with AFCA is fast approaching and is the 30th of June, 2025

- Our Role: Claimo is working with AFCA to request an extension of this deadline, but no guarantees can be made.

- Important Note on Timeframes: Claimo will make every effort to submit claims as soon as possible; however, submission times can vary.

- Unawareness After February 2019: Consumers who can provide evidence showing they were unaware of add-on insurance concerns after 4th of February 2019 may still be eligible to have their claims assessed.

Time‑Critical: Make Your Add‑On Insurance Refund Claim by June 30 with Claimo

If you purchased an add-on insurance policy — such as Consumer Credit Insurance (CCI), Guaranteed Asset Protection (GAP), tyre & rim cover, or extended warranty — attached to a car loan, novated lease, personal loan, home loan, or credit card prior to 1 July 2019, it’s time to act.

The Australian Financial Complaints Authority (AFCA) has set a hard deadline of 30 June 2025 for lodging complaints related to older add‑on insurance products. After that date, your complaint won’t be accepted. Claimo is here to help you file your complaint on time—and potentially win a full or part refund—without the hassle of doing it yourself.

If you wait until after 30 June 2025, the AFCA may refuse to hear your case—regardless of how unjustly the policy was sold. That could mean losing the chance for full or partial compensation. Claimo is the best team to handle the case for you as we have a high claims success rate and can help you obtain all of your documents to perform your refund.

What’s the 30th of June 2025 Deadline About?

Under AFCA’s rules, complaints about add‑on insurance purchased before July 2019 must be submitted by 30 June 2025. If you miss that date, AFCA can no longer review your case—even if you believe you were sold an unsuitable or misrepresented policy

In short, the last date to lodge a complaint about this type of older add-on insurance is 30 June 2025.

Frequently Asked Questions

1. What is the 30th of June 2025 deadline?

The Australian Financial Complaints Authority (AFCA) set this deadline for consumers to file complaints related to add-on insurance to AFCA. Submitting a claim by this date ensures your case is considered by AFCA. The fact sheet from AFCA can be found here.

2. What can Claimo do to help me?

Claimo operates on a no win no fee basis and charges 30% plus GST for any amount settled. We will work on your behalf, aiming to ensure your case is lodged with AFCA before the 30th of June 2025 deadline. We’re also in discussions with AFCA to explore the possibility of an extension. Our position is that the deadline is unfair and favours the banks over consumers.

3. What if I didn’t know about these insurance issues after February 2019?

If you were unaware of add-on insurance concerns as at 4th of February 2019, you may still be eligible for review. Claimo may ask AFCA to investigate cases that might be considered if evidence indicates that the consumer was unaware of these issues at that time.

4. What kind of evidence do I need to provide?

AFCA has not specifically outlined what evidenced, if any. However, Claimo may ask you to provide a written statement explaining your situation and confirming that you were unaware of the issues after 4 February 2019. This may support your case in showing you missed the earlier information release.

5. Can Claimo guarantee that my case will be lodged before the deadline?

Due to varying timeframes and the need for claims to be first assessed by financial firms, Claimo cannot guarantee that every claim will be submitted to AFCA before the 2025 deadline. We will continue to do everything possible to meet this deadline for our clients. Our teams are working extensively to ensure that claims can be assessed before and after the proposed deadline.

Key Steps to Take

1. Contact Claimo: Reach out as soon as possible to begin your claim process.

2. Prepare Your Information: Consider preparing a written statement in email if

you believe you were unaware of these issues as at 4th of February 2019.

3. Submit Promptly: The sooner we receive your information, the better our

chances of submitting your claim on time.

Contact information: For further assistance, please call Claimo on 1300 879 071.

Legal Stuff

Claimo Pty Ltd is a claims management business designed to provide information to

clients who wish to have a claim managed on their behalf.

This service does not provide legal or financial advice. Consider whether this service is right for you. If you are unsure, seek independent legal advice. Claimo operates on a no win no fee

basis and charges 30% plus GST for any amount settled.